- February 21, 2023

- Posted by: Seed2Exit

- Category: Insights

Congratulations Founders!! You have just closed a substantial A Round. And now, the expectations from your investors have multiplied 10X. New pressures will now face the Founding team, including expectations of faster revenue growth, a steeper valuation and an accelerated timeline to Exit.

Let us look at the key factors that led to you closing your Series A round. One of your most significant accomplishments was finding and closing your first paying customer(s). You have also begun to articulate a sales model that shows you understand your customer in a defined demographic/market sector. Now it is time to grow your customer base and understand how to scale your business without increasing the cost of customer acquisition. The growth metrics you presented to your investors will add significant pressure to demonstrate that you can scale the business thoughtfully.

Moreover, the next 18 months are going to be very challenging with rising interest rates, a slowing economy and a more difficult fundraising environment. The Founding team’s decisions to hire, train and integrate new staff will be tested, especially with the need to maintain the burn rate within reasonable expectations. Thus, raising the question who do we hire full time and who do we outsource? This is where IT Staff Augmentation services can offer a flexible solution for scaling your team without incurring high fixed costs.

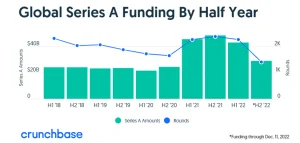

On the other side of the board room table, investor expectations for the use of A Round capital will go beyond the agreed growth milestones and also may encompass an Exit strategy, especially if the economic downturn continues. As seen as this recent published chart from CrunchBase, venture funding is in overall decline since the middle of 2022:

The tough reality in the Venture Business is that Founding Teams are focusing on executing their growth strategy to attract future investment rounds, while existing investors may be prospecting for a successful exit strategy that can take up to 12-18 months.

A Founders’ desire to successfully build the business they imagined and founded and the investors self-interest in maximizing their investment often lead to tension. Key advice on to navigate these choppy waters needs to come from experienced advisors who understand Founders’ ambitions to scale their business, while not discounting investors’ legitimate motivations.

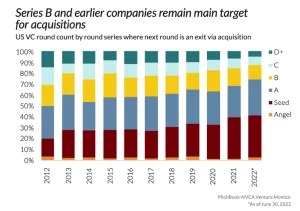

Historical trends show that Series A companies have a higher exit rate then later funding rounds:

In fact, IPO Unicorn exits have been in decline since 2018 and the economic slowdown will further accelerate this trend:

As Series A investors often favor exit strategies that involve strategic partnering with key market leaders, the Founding team should explore growth models that involve licensing and OEM agreements with established companies that can both drive sales and revenue but also represent an M/A Exit opportunity down the road.

We know that Founders start their business with the passion to disrupt an industry, bring to market a game changing technology and/or contribute positively to the World; however, Founders cannot lose sight of the fact that their investors bottom line is to make a very significant profit in line with the expectations that have set with the Funds investors, the Limited Partners.