- June 27, 2023

- Posted by: Seed2Exit

- Category: Insights

Overall Decline in VC investments

In these turbulent economic conditions resulting from the wide-reaching impact of the Russian invasion of Ukraine — including inflationary pressures and rising interest rates which have led to a notable drop in VC investing — it seems a bit contrarian to suggest that there is an “Emerging Opportunity for Innovation and Market Growth in Climate Tech.” However, a closer examination of investment trends over the past 2 years suggests that a big opportunity still exists.

First, let us review some key VC investment statistics for 2022-2023 to set the stage for our conversation as provided by the excellent resource, Pitchbook.

The Latest Pitchbook Report on European VC Outlook, Q1 2023, found that:

“European VC fundraising is on pace for its lowest annual figure since 2015. Funds closed in Q1 2023 may have been launched in 2022, and we are now seeing the effects of weakened desire from GPs and LPs to launch and commit to new VC funds. Q1 2023 reflected the first substantial decline from the pace set in the past four years, and the VC ecosystem could finally be displaying the effects of the challenging fundraising conditions.”

Pitchbook Venture Monitor Q1 2023 further highlights the difficult headwinds facing Equity Venture financing in USA, as well:

“As expected, our data [Pitchbook] shows that deal activity for early-stage venture, despite the stage’s presumed insulating nascency, declined significantly throughout the first quarter of the year. Q1 saw just $9.6 billion in deal value across an estimated 1,197 deals, a six-quarter consecutive decline in deal value and the lowest deal value we have observed since Q2 2020. It is clear that the venture market is no longer riding on the coattails of 2021, a harsh reality for both startups and investors in the current environment.”

One of the most striking findings thus far has been the decline in early-stage deal sizes, with the median deal size in Q1 falling to $6.2 million, a 29.1% decline from 2022’s full-year median of $8.8 million. This notable drop reflects a harsher dealmaking environment with tempered growth expectations and far fewer outsize valuations relative to the past two years.

So, what can we derive from some rather ugly realities in VC investing after the boom years of 2020 to Q2 2022?

As we begin 2023, many tech companies have been hit hard by the market downturn and have been forced to layoff staff.

Climate Tech Remains A Bright Spot for VC Investment

Climate tech on the other hand has emerged as a bright spot in the midst of these difficulties. In 2022, climate tech saw record-breaking levels of investment, even higher than its impressive performance in 2021. Emerging technologies like VR Development Services are also seeing increased attention as they can play a role in simulation and planning for climate solutions.

The brutal Russian invasion of Ukraine has led the European Union and especially Germany to renew and accelerate its commitment to renewable energy. Combined with the broader climate crisis which has resulted in extraordinarily hot summers and droughts in Southern Europe has only further highlighted the critical importance of climate tech innovations to address the challenges of global climate change. At the same time, four years of ever larger wildfires and extreme drought conditions in West of the United States and Canada have also focused attention in North America on the role that Climate Tech must play in addressing the growing negative consequences of Climate Change.

Climate Tech Cooperation and Cross Border Investment Opportunities

The USA and Europe have a golden opportunity to work more closely together to address the competitive challenge that China’s investments in many key components of the renewable energy sector, such electric cars, solar energy, etc., represents to both economies.

What is the current state of affairs in the Climate Tech investment cycle?

According to Net Zero Insights Analysis, “The State of Climate Tech Investment in 2022,” $82B were raised by Climate Tech companies across Europe and North America, +19% over 2021. Looking more closely at 2022 we observe that the amount raised in USA was $43.9B, while in Europe it was slightly less at $36.6B. However, comparing year on year growth, Europe investment grew by 26% faster than the USA.

Specific categories of Climate Tech investments, namely, Direct Air Capture, Carbon capture, utilization and storage (CCUS), carbon accounting and supply chain tracking have all skyrocketed in 2022.

The Energy sector raised $42B in 2022, growing 56% YoY. Batteries, hydrogen and solar were the most funded technologies. If we examine the actual funding and number of deals in Climate Tech, there was a clear decline from the highwater mark of Q1 2022. Nonetheless, investment in Climate Tech remains fairly strong compared to the Overall VC investment climate.

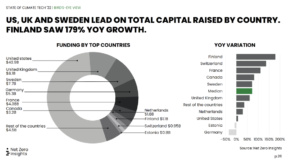

Climate Tech Investments By Country

When we closely examine the breakdown of Climate Tech investments by country, we discover some surprising findings. Namely that the USA, the UK and Sweden are the largest single markets for Climate Tech fundings, whereas the fastest growing market is Finland at 179% YoY growth. In the USA, The State of California stands out with $15.3B in investments 4X above any other US state. Among major cities, Stockholm, San Francisco and London were the investment centers in 2022.

Federal Action: The Inflation Reduction Act

In August 2022, President Biden signed the Inflation Reduction Act (IRA). The mix of direct investment, tax credits and research funding will shape the US Climate Tech future across many industries – from energy to transportation to manufacturing to food & agriculture to natural capital – by offering 10 years of consistent policy support.

The passage of IRA is one of the most historic acts by Congress to address Global Climate Change, unfortunately it was not bipartisan vote which is a shame as Climate Change is impacting everyone regardless of political affiliation. Moreover, some in the GOP, especially those representing Oil and Gas States, have claimed that the IRA tax credits need to be eliminated to reduce US federal debt. Hopefully, this backward thinking will not prevail.

What’s in the Inflation Reduction Act (IRA) of 2022 | McKinsey

One of the most exciting elements of the legislation is the approval of more than $300 billion in loans from the Department of Energy to groundbreaking technologies. Globally, it could make the US more competitive for climate-tech Foreign Direct Investment (FDI) inflows and as an overall leader in Climate Tech space.

As part of the implementation of IRA, the US Department of Energy (DOE) Loan Programs Office has set up as a private-sector led, government enabled program. The DOE’s loan program provides debt financing to innovative projects brought to the US Government by the private sector.

Loan Programs Office | Department of Energy

Although there has been much complaining in the European Union about the potential negative impact that IRA will have on European Climate Tech investments, the European Union has not been standing still over the past few years.

The European Innovation Council (EIC) was launched in March 2021 as a major novelty under the Horizon Europe program building on a pilot phase from 2018–2020. It has a budget of over €10 billion between 2021–2027 to support game-changing innovations, including blockchain development services, throughout the lifecycle from early-stage research to proof of concept, know-how transfer, and the financing and scale-up of startups.

Climate Tech Initiatives at US State Level

Climate Tech Initiatives across at the US State level has been building gradually. The two most aggressive states, California and New York, have been very active with policies for decarbonization and energy transition programs that emanate from the State’s Energy Commissions, Utilities and their respectful University programs.

In New York State, Governor Hochul launched a pledge of $1B a year for Climate Action Rebate to drive the transition for all New Yorker residents. The focus is on Affordability, Climate Leadership, Creating Jobs, and Investing in Disadvantaged Communities.

The Climate Tech innovation ecosystem backed by NYSEDRA is focused on mission-critical ecosystem of pooled resources to drive climate tech and clean energy startups, early-stage developers, and major industry innovators, enabling transformative technologies on the path to net zero.

California has been active in climate tech since Governor Jerry Brown passed AB8 legislation in 2014. AB8 commits $20M/year to programs like the Zero Emissions Vehicle program. As of 2022, California Climate Investments implemented nearly 19,500 new projects through $1.3 billion in funding in 2022 alone, with $933 million directly benefiting disadvantaged communities and low-income communities and households.

California Climate Investments

Under current Governor Newsom, the California Energy Commission programs focus on Fuels and Transportation, Decarbonization, Energy Efficiency and Reliability. Through 2022, the CEC has invested about $300M into Electricity System, Natural Gas System, Agricultural Energy Savings, Research Planning and Implementation. These investments are available as Grants but also as spurred private investments to see these projects through to success.

In another 22 US States some level of government incentives to reduce greenhouse gas emissions in the form of tax breaks, grants or other government support has been enacted. Once again, just as on the Federal level, most Republican led states, especially Oil and Gas States, have not joined the efforts to address Climate Change. An excellent overview of ClimateTech efforts is provided at:

From the perspective of European Climate Tech company, the West Coast of the USA is the best and most attractive region to establish a business presence.

Conclusion

Seed2Exit believes that the Climate Tech represents an excellent opportunity for transatlantic investments in both select US States and across Western Europe. Favorable governmental policies at the US state level will open up new markets for European companies that are leaders in Climate Tech. The same is true for leading US Climate Tech companies wishing to build their market presence in Western Europe.

The Global Team at Seed2Exit will be seeking to identify opportunities to assist Climate Tech startups with their international expansion plans. If you are interested in exploring new markets in Europe and the USA, please contact us at info@seed2exit.com